From 1ᵉʳ March 2025, the Taxe de Solidarité sur les Billets d’Avion (TSBA) will see a significant increase in France. This reform will have a direct impact on the business aviation sector, particularly charterers of private jets and commercial aircraft. From that date, the tax will apply to all passengers departing from France.

What are the new tax amounts?

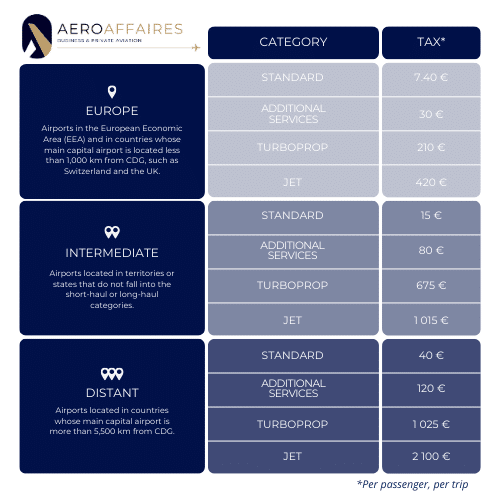

Private jets (turboprops and business jets): the TSBA will increase from €210 to €2,100 per passenger, depending on the type of aircraft and the distance flown.

- 420 per passenger for an intra-European flight

- 2,100 per passenger for a long-haul flight

| Type of flight | Turboprop | Turbojet (private jet) |

|---|---|---|

| Intra-European flight (Switzerland – United Kingdom) | 210 € | 420 € |

| Intermediate destination (between 2,000 and 5,500 km) outside Europe | 675 € | 1 015 € |

| Long-haul (> 5,500 km)* | 1 025 € | 2 100 € |

10% VAT will also apply to domestic flights in France, but will not affect international departures.

* Short-haul – Airports in the European Economic Area (EEA) and countries whose main capital airport is less than 1,000 km from CDG (e.g. the United Kingdom, Switzerland).

Medium-haul – Airports located in territories or states that do not fall into the short-haul or long-haul categories.

Long-haul – Airports located in countries whose main capital airport is more than 5,500 km from CDG.

Example: Private flight Nice – Valladolid

| Item | Amount (€) |

|---|---|

| Estimated price (excluding tax) | 12,000 € (variable depending on equipment) |

| Standard taxes and fees | 1 500 € |

| Total cost before new tax | 13 500 € |

| New tax (7 passengers x €420) | 2 940 € |

| New total cost | 16 440 € (+22 %) |

For more information, you can consult the official text in the Journal Officiel (JORF n° 0039 of 15 February 2025) as well as the Committee Text n° 873-A0 of the National Assembly.

Why this reform?

The stated aim of the authorities is twofold:

- To increase public revenue, in particular to finance projects linked to the ecological transition.

- To encourage the reduction of CO₂ emissions by making air transport more expensive for users.

However, to encourage more sustainable aviation, a 50% tax credit is provided on the purchase of sustainable aviation fuels (SAF), with a ceiling of €40 million per year.

A direct impact on business aviation in France

According to Charles Aguettant, President of the French branch of the EBAA ( European Business Aviation Association), this new tax could represent between 20% and 90% of the price of a flight, depending on the aircraft and the destination. This reform mainly affects French operators, who could see their competitiveness impacted in the face of international competition.

A direct impact on the attractiveness of France

This increase in costs is likely to lead to a flight of traffic to other European countries.

- Why take off from Nice when Albenga (Italy) is a 40-minute drive away with no surcharges?

- Why take off from Biarritz when San Sebastián (Spain) offers a cheaper alternative?

A threat to French airports and the local economy

This reform could have major consequences:

- A drop in private jet traffic, leading to a reduction in revenue for regional airports

- Negative economic impact on hotels, restaurants, yachting and all the businesses that depend on this high-end clientele

- Reduced attractiveness of France to international travellers, who could opt for destinations such as Tuscany, Ibiza or Tivat.

How can AEROAFFAIRES help you?

- Automatic inclusion of tax in our fares for all private flights departing from France

- Monitoring of regulatory changes to ensure a smooth and compliant experience

- Personalised advice to optimise your itineraries and choose the best options

Will this tax change the way you travel?

Would you like to consider a departure point other than France for your next private flights?

Contact our team now to analyse your situation and find the solutions best suited to your needs.